National Fair Housing Month 2023: Debunking Affordable Housing Myths

The national shortage of affordable housing is a known and growing crisis recognized across generations and states. Half of Americans say the availability of affordable housing in their local community is a major problem, according to a Pew Research Center survey[1]. That number is up 10% from early 2018.

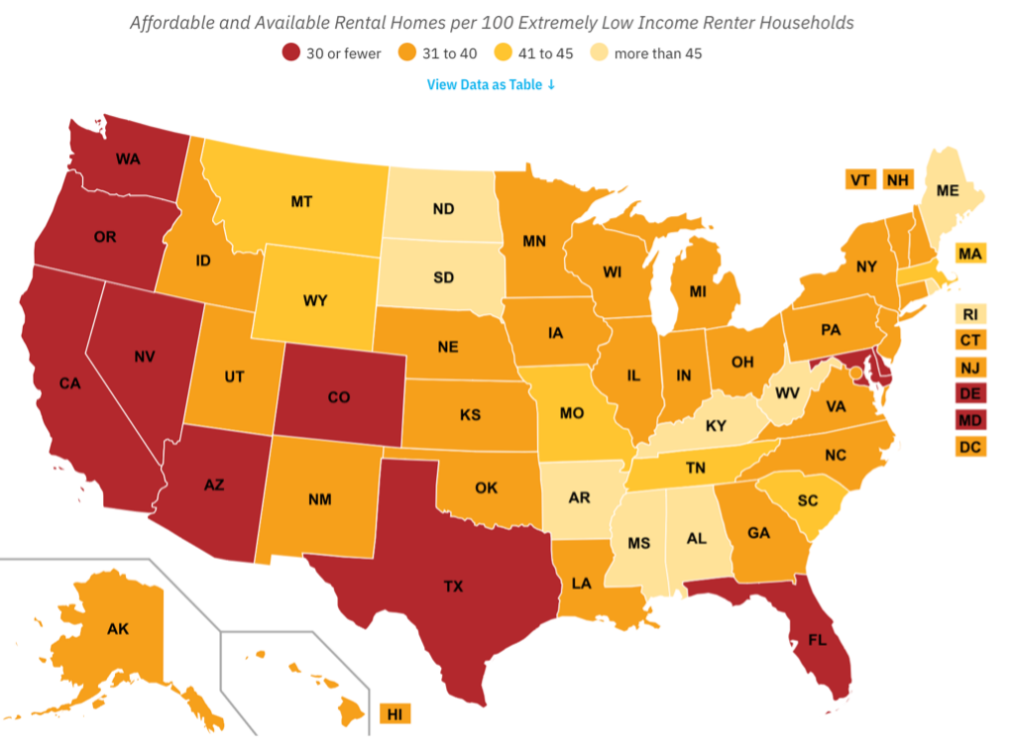

The crisis is most pronounced among the nation’s poorest. A March 2023 report from the National Low Income Housing Coalition finds that the U.S. low-income housing market faces a gap of 7.3 million affordable and available rental homes. For extremely low-income renters, there are only 33 affordable rentals for every 100 households[2].

This shortage falls on all states – and 50 of the largest metro areas – with a disproportionate impact on minority communities of extremely low-income renters. While only 6% of white households are extremely low-income renters, 19% of Black non-Latino households; 17% of American Indian or Alaska Native households; and 14% of Latino households are. These disparities reflect longstanding, discriminatory systemic issues across the housing space.

The financial burden of the affordable housing shortage weighs heavily. According to the Harvard Joint Center for Housing Studies, families in affordable housing enjoy many additional financial freedom: Families in affordable housing can spend nearly five times as much on healthcare, a third more on food, and double on retirement savings[3].

Supporting Fair Housing Practices

Despite this urgent need, persistent myths leave too many people believing that affordable housing harms neighborhoods and local communities. In fact, affordable housing does the opposite: It has a ripple effect of broad benefits and drives deep, lasting positive impact for communities.

IMPACT Community Capital (“IMPACT”) is proud to honor fair housing practices, especially during this crucial time. This April, we are honoring the 55th Anniversary of the passage of the Fair Housing Act: the landmark civil rights law that made discrimination in housing transactions unlawful, per the U.S. Department of Housing and Urban Development (HUD).

This National Fair Housing Month, we are addressing four myths about affordable housing and highlighting the facts that point us toward meaningful progress. With this clarity, we hope to build the drive toward affordable housing solutions that can benefit the entire country.

Debunking Myths with Facts

Myth 1: Affordable housing leads to more crime and unsafe surrounding communities.

FACT: CASE STUDIES HAVE FOUND THAT AFFORDABLE HOUSING DOES NOT INCREASE CRIME RATES IN THE SURROUNDING NEIGHBORHOOD.

Perhaps the most common misconception about affordable housing is that it creates unsafe neighborhoods. However, the University of California Irvine’s Livable Cities Lab (LCL) conducted a 2022 case study showing a decrease in crime[4]. The presences of affordable housing does not influence the level safety as preconceived notions may assume. In certain areas where affordable housing went up, crime rates even decreased with public safety resources in place.

LCL aggregated crime rates before and after the placement of affordable housing in communities throughout Orange County, California, and found a decrease in the most violent crimes, such as robbery and assault. In comparing crime rates before and after the placement of affordable housing in neighborhoods, the study found that the number of aggravated assaults in blocks within one-fifth mile declined after placement, whereas there is effectively no difference at longer distances.

Other researchers have arrived at similar findings. Stanford Business School released a 2015 report analyzing crime rates in neighborhoods with affordable housing[5]. Stanford’s researchers found that the number of both violent crimes and property crimes declined in low-income areas with affordable housing. Furthermore, in high-income areas, findings showed no increase in crime.

Myth 2: Affordable housing decreases the surrounding property values.

FACT: AFFORDABLE HOUSING HAS THE ABILITY TO INCREASE PROPERTY VALUES.

A concern that drives opposition to affordable housing is about surrounding property values. In fact, the UC Irving LCL case study found the opposite. Property values actually increased following the completion of an affordable housing development. To ensure accurate analysis, the study adjusted sale prices for inflation and for housing market trends with a particular focus on the 2008 recession impact. With these adjustments, observed house sales within one-fifth mile of the affordable development increased by an average of about $15,800. Similarly, among homes sold about a half-mile away, the observed increase in sales price was about $14,200, and homes sold one mile away increased by $13,500.

Similarly, the Metropolitan Housing and Communities Policy Center at the Urban Institute conducted a 2022 study in Alexandria, Virginia, which found an increase in property values near new affordable housing of 0.9%[6].

Additional research with broader geographic perspective nuances our understanding of this topic. Last year, the Journal of Housing Economics cited a national analysis, which surveyed 129 counties across 15 states, that also found an increase in property values[7]. Property values of houses within one-tenth mile of newly constructed or rehabilitated Low-Income Housing Tax Credit (LIHTC) developments in low-income neighborhoods increased by 6.5% over ten years, while values of homes within the same distance of LITHC developments in moderate and upper-income, majority-white communities fell by 2.5%.

Myth 3: Affordable housing leads to undesirable aesthetic changes in neighborhoods and less attractive communities.

FACT: THERE IS AN UPTICK IN RESOURCES AND TALENT DEDICATED TO HIGH-QUALITY, SUSTAINABLE DESIGN FOR AFFORDABLE HOUSING.

Recent years have witnessed a growing dedication to visually attractive and environmentally friendly affordable housing designs. In 2020, the Joint Center for Housing Studies of Harvard University and The Brookings Institution released new design strategies for affordable housing[8]. The strategies help designers make plans that are aesthetically appealing while meeting all the essential requirements of safe and healthy housing.

In similar pursuits, city governments have increased their commitments. New York City’s Public Design Commission, for example, strongly emphasized the role of design in its plans to build 300,000 affordable homes by 2026[9].

On the talent side, more architects are offering alternative and sustainable solutions to the outdated designs of the modernist era in affordable housing. Architecture blogs now routinely showcase the most attractive affordable housing projects worldwide. IMPACT is proud to support this focus on enhanced design with recent properties we’ve financed, such as the Miramar Santa Monica and Jamboree Rockwood in Southern California, as well as Burlington Common in Knoxville, Tennessee.

Other examples demonstrate how sustainability is rising for affordable housing, such as PUSH Buffalo in Buffalo, New York, Solar-for-Vouchers in the Twin Cities, Minnesota, and Community Climate Collaborative in Charlottesville, Virginia. These are just a few of the efforts fusing climate and housing goals to close equity gaps and increase access to renewable energy.

Myth 4: Affordable housing strains and depletes local economies.

FACT: AFFORDABLE HOUSING BOOSTS LOCAL ECONOMIES BY SUPPORTING THE CREATION OF JOBS, THE INCREASE OF INCOME LEVELS, AND LOCAL REVENUE.

Counter to the myth that affordable housing is an economic liability to its community, studies find that such housing reduces intergenerational poverty and increases economic mobility. In fact, research shows that the shortage of affordable housing costs the American economy about $2 trillion a year in lower wages and productivity. In contrast, sufficient access to affordable housing effectively increases residents’ chance for economic mobility. With affordable housing, earnings as adults increase by approximately 31%, and there is a greater likelihood of living in better neighborhoods as adults[10].

The National Low Income Housing Coalition (NLIHC) reports that the growth in GDP between 1964-2009 would have been 13.5% higher if families had better access to affordable housing. This would have led to a $1.7 trillion increase in income or $8,775 in additional wages per worker[11]. In a partnered study between NLIHC and Campaign for Housing and Community Development Funding (CHCDF), researchers analyzed HUD’s overall impact on job creation by analyzing data on HUD’s major housing programs as their funding levels adjusted for inflation. Estimates show that in fiscal year (FY) 2015, HUD investments supported 537,297 jobs. Of those jobs, HUD programs directly supported 301,217 jobs, while 236,080 were supported indirectly[12].

Additionally, the National Association of Home Builders (NAHB) found that additional housing uplifts local economies. The NAHB based its findings on the average market value of multifamily units, average annual property taxes, and national averages from the U.S. Census of Government. In one year of building 100 rental apartments, a local area’s impact includes $11.7 million in local income, $2.2 million in taxes and other revenue for local governments, and 161 local jobs. After the first year, on an annual reoccurring basis, the impact on the local area becomes $2.6 in local income, $505,000 in taxes and other revenue to local governments, and 44 local jobs[13].

Building a Future on the Facts

Based on the facts detailed above, IMPACT drives toward its vision of advancing opportunity in underinvested communities through purpose-driven investments, largely in affordable housing. We finance affordable housing in communities across the U.S. with institutional-scale investments that deliver risk-adjusted returns for our investors and positive real-world outcomes for residents. We know the need is widespread, so we invest in affordable housing in all types of communities, in counties with the full range of Social Vulnerability Index scores[14].

Our affordable housing investments provide far more than shelters. These investments support individuals who no longer must choose between paying rent and paying for other essentials, such as healthcare and food. As emphasized in our 2022 Impact Report, entire families stand to benefit. Quality-of-life benefits, such as economic well-being and safety, extend well beyond the properties we finance. Access to affordable housing can create stability and resilience that is essential to all communities.

As we look ahead to building a future based on facts rather than myths, we are committed now more than ever to driving long-term change. Over the past 25 years, IMPACT has invested more than $1.4 billion dollars to create and preserve access to affordable housing across the U.S., and our work continues to grow – with more than $767 million in future capital commitments presently in place.

[1] Source: https://www.pewresearch.org/fa...

[2] Source: https://nlihc.org/gap

[3]Source: https://nlihc.org/sites/defaul...

[4] Source: https://cpb-us-e2.wpmucdn.com/...

[5] Source: https://www.gsb.stanford.edu/f...

[6] Source: https://www.urban.org/research...

[7] Source: https://taahp.org/wp-content/u...

[8] Source: https://www.jchs.harvard.edu/b...

[9] Source: https://www.nyc.gov/assets/des...

[10] Source: https://nlihc.org/explore-issu...

[11] Source: https://nlihc.org/explore-issu...

[12] Source: https://nlihc.org/sites/defaul...

[13] Source: https://www.nahb.org/-/media/N...

[14] The Social Vulnerability Index (SVI), released by the Center for Disease Control, examines several social variables – including crowded housing, transportation access and poverty levels – to measure the degree to which a community would be susceptible to crisis or disaster.